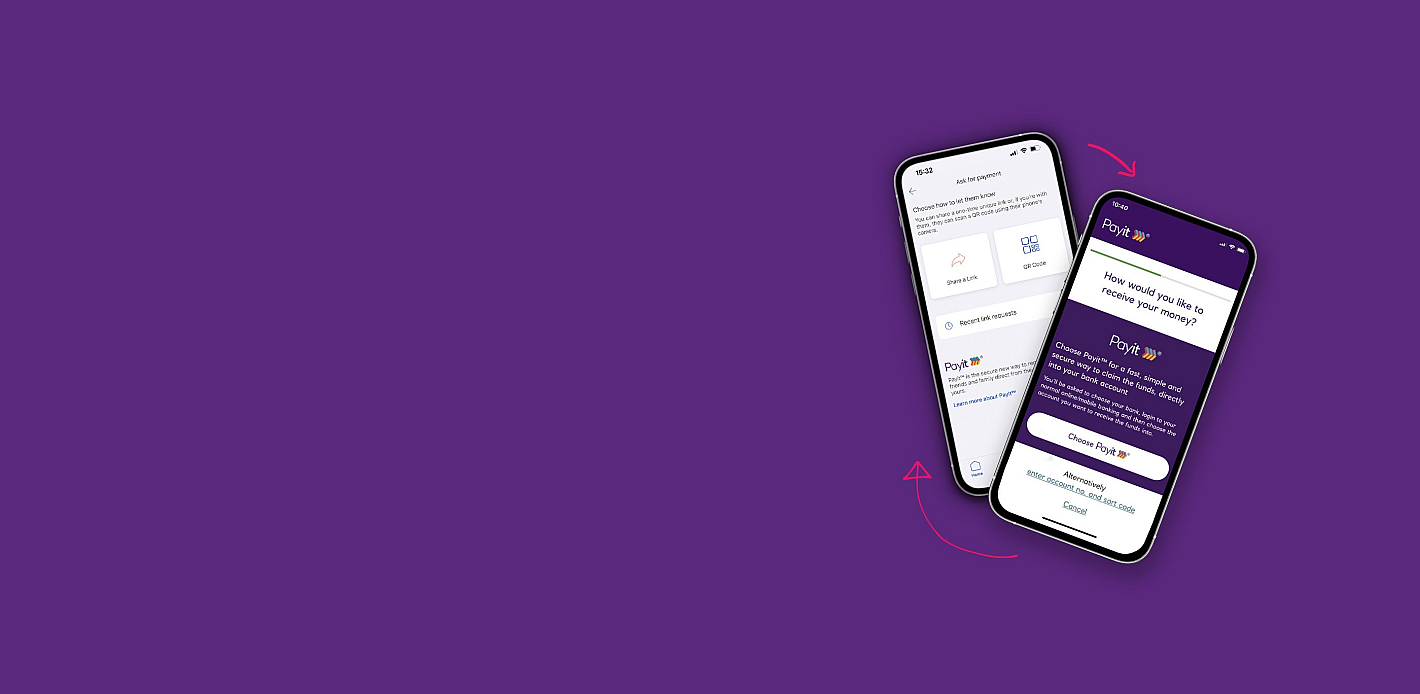

Payit™ : Your new favourite way to be paid

The award-winning way to accept payments without giving out any card details. Payit from NatWest comes to Tyl e-Commerce Payment Gateway so you can get paid easier and possibly… cheaper.

Tyl and Payit eligibility criteria, terms and conditions and fees apply.

The fast and the secure-ious

As a Tyl e-commerce customer, you already accept card payments – they’re simple, fast and more convenient than cash. With the addition of Payit, you have an alternative safe and secure way to accept payments via a bank-to-bank transfer.

You even don’t need to store sensitive payment information , and neither does your customer – no typos or anything for scammers to grab. Just send your customer a URL link, then they pay direct from their banking account.

And neither of you need to bank with NatWest (although, of course, we’d love you to).

How Payit could help your business

Whether you’re processing lots of small transactions or just a few big ones, Payit can cope with whatever you throw at it. And remember, those transaction fees are capped, helping you keep more of the profits of your big transactions.

Awards and accolades

See what the industry thinks of Payit

Payments Awards 2022

Best Online Payments Solution – Consumer & PSD2 or Open Banking Initiative of the Year & Best Merchant Acquirer or Processor Category

PAY360 Awards 2022

Best Direct Account to Account Solution

Open Banking Expo Awards

2022 Best third party provider

FAQs about Payit

How does Payit work?

Payit uses Open Banking APIs (Application Programming Interface – software that allows two separate computer programs communicate) to enable payments without exchanging account details. This is achieved by a customer authorising us, through their bank's secure identification process, to initiate a payment on their behalf by making a secure API call to their bank account provider.

With Payit being offered through Tyl, your customers can choose to pay you via this handy service. We do this by integrating Payit payments as an option in the Tyl payment gateway (your 'checkout’). We then receive payments made via Payit on your behalf, then settle those payments into your bank account the next business day, as a combined payment.

Here’s how the process works, step by step:

- Your customer wants to check out and selects Payit as the payment option (in our hosted payment page)

- Your customer is automatically directed to Payit’s bank selection page and your customer is asked to select their bank

- Payit links to your customer’s bank (via an API) and connects them to their banking website or mobile app

- Your customer authorises Payit to make a payment. They authenticate with their bank to open a secure connection between Payit and their bank account provider. Their bank sends payment consent and redirects to Payit

- Payit sends a payment request to your customer’s bank and receives a payment ID in return confirming a “Faster Payment” has been initiated

- The customer is shown confirmation of payment by Payit and control is handed back to your website

- Payit sends payment status to us

- We redirect the customer to the Payment Confirmation page

What are the fees?

Payit payments have a low transaction fee (0.3%), plus a small processing fee (£0.03 per transaction) and how much you pay is capped to a maximum of £3. So, you’ll never pay more than that. You could save money on higher price transactions every time.

Do I need to be a NatWest customer to use Payit?

No, neither you, your business or your customers have to bank with NatWest Group to use Payit. You can use Payit as part of your overall Tyl service.

How long does it take for me to receive my Payit payments?

Our settlement process for Payit transactions has been aligned to match your existing card payments, so all Payit transactions are settled to you on the next business day as a bulk payment.

In a very small number of cases, the paying customer’s bank may withhold a payment prior to its release (for example, to perform checks on suspected fraudulent transactions). In this scenario, Payit will return a “Pending” status to you. You can check on this in the Virtual Terminal. Tyl will continue to contact the customer’s bank for updates for up to 6 days, after which point the payment will be declined and marked as “Failed” in your Virtual Terminal.