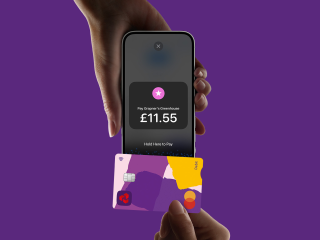

Take contactless payments with just your phone

The NatWest Tap to Pay app gives your smartphone the abilities of a

Tyl-powered payment solution. Take contactless payments in all kinds of

places, with no extra hardware. Tap to Pay comes with a flexible plan. You can end it any time with 1 month's notice.

No monthly hire or PCI

fees for Tap to Pay. Transaction fees and limits apply. Some contactless

cards not accepted. Users may be charged for data usage by their

network operator. Available on iPhone XS or later with iOS 16.7 or later

and Android OS 11 or later with Google Services and NFC.

Subject to Tyl eligibility criteria and terms and conditions.

No extra hardware – no extra rental costs

Save on the cost of card readers by supercharging your existing smartphone to do all that card-tapping, stuff-selling hard work.

Save on card reader costs

No card reader rental or purchase costs*. You’ll still need to be a Tyl by NatWest customer. *Tyl eligibility criteria, terms, conditions and fees apply.

Take payments, anywhere

All you need to make a sale is a mobile data connection (and allowance) or Wi-Fi, your smartphone and NatWest Tap to Pay.

Mobile, but secure

All the security you’d expect from one of the UK’s biggest high street banks, plus your built-in on-device protection – fingerprint, facial recognition, PIN, and two-factor ID.

iPhone and Android welcome

Tap to Pay on iPhone

Requirements:

- iPhone XS or later.

- iOS 16.7 or later.

- Update to the latest iOS version for the best experience.

- Check your iPhone settings for details.

Good to go?

Tap to Pay on Android

Requirements:

- Android device running operating system (OS) version 11 or higher.

- Your phone supports Google Services – an app usually installed as standard.

- NFC (Near Field Connectivity) enabled. If you use Google Pay to pay for things with your phone, you have this.

- Check your phone’s setting for details.

Got all four? Great. We’re good to go.