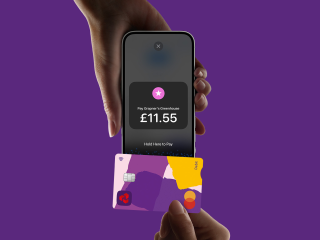

Accept contactless payments with only an iPhone

Tap to Pay on iPhone. Now available with Tyl by NatWest.

Tap to Pay comes with a flexible plan. You can end it any time with 1 month's notice.

No monthly hire or PCI fees for Tap to Pay. Transaction fees and limits apply. Some contactless cards not accepted. Users may be charged for data usage by their network operator. Available on iPhone XS or later with iOS 16.7. Subject to Tyl eligibility criteria and terms and conditions.

Contactless payments on tap

No card machine to rent or buy

Taking care of your worries

Legal disclaimer

Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. View Tap to Pay on iPhone countries and regions.

Why Tap to Pay on iPhone and Tyl?

Download the app for free

No rental costs or hidden charges, just a transaction fee (other fees may apply).

Make sales wherever you go

As long as your iPhone can connect to data, you can be taking contactless payments.

Looking to reduce costs?

8/10 customers could save on transaction fees when switching to Tyl*.

*Savings based on customers looking to switch from various providers to Tyl between October 2023 and September 2024. Your existing provider may charge an exit fee. Average savings not inclusive of introductory offers or any exit fees you may have been charged. Additional fees may apply for data usage or app downloads. Tyl eligibility criteria, terms, conditions and fees apply.

Find out all you need to know about Tap to Pay on iPhone in our handy user guide.

What our customer says

Get started with Tap to Pay on iPhone

New to Tyl by NatWest?

To use Tap to Pay on iPhone, you’ll need to join Tyl by NatWest. If you haven’t already chatted to our team about joining, simply fill in the form or give us a call on 0161 605 6626, or 18001 0345 901 001 for Relay UK and we’ll handle the rest.

Once your Tyl account is approved, we’ll send you your NatWest Tap to Pay login details and a link to download the app. Easy.

Already a Tyl customer?

Add NatWest Tap to Pay on iPhone alongside your existing card machine(s). Simply give us a call on 0345 901 0001 or 18001 0345 901 001 for Relay UK and have your Merchant ID number to hand.

Once we apply these changes to your account, we'll send you your NatWest Tap to Pay login details and a link to download the app. Easy.

Tap to Pay on iPhone FAQs

What is Tap to Pay on iPhone with NatWest Tap to Pay?

Tap to Pay on iPhone with NatWest Tap to Pay enables Tyl customers to accept contactless payments directly on their iPhone (iPhone XS or later using iOS 16.7 or later) without the need for any additional physical hardware.

Find out all you need to know about Tap to Pay on iPhone in our handy user guide.

I’m a sole trader and I don’t have a registered business number. Can I still apply for Tap to Pay on iPhone?

Yes, we’d love you to join the Tyl family. We’ll just need to see some additional documentation to process your application and check everything is in order.

Please have the following documents ready to provide after you've submitted your application:

- A copy of a recent utility bill in your trading name (e.g. phone, internet, gas, electricity, water)

- A copy of your VAT registration (if applicable)

- A copy of your business accounts or tax return (if applicable)

- Previous 6 months personal/business bank account statements

- A copy of a current Public Liability or Personal Indemnity insurance policy

- Confirmation of Regulatory Body or Membership of Professional/Trade Association (If applicable)

Note: If you do have a registered business number because you are a limited company or Limited Partnership, you don’t need to provide the above additional documents.

Is Tap to Pay on iPhone with NatWest Tap to Pay safe?

Tap to Pay on iPhone uses the built-in features of iPhone to help keep your business and customer data private and secure. When a payment is processed, Apple doesn’t store card numbers on the device or on Apple servers, so you can rest assured knowing your business stays yours.

What payment types can I accept with Tap to Pay on iPhone with NatWest Tap to Pay?

With Tap to Pay on iPhone with NatWest Tap to Pay, you can accept in-person contactless payments right on your iPhone including credit/debit cards and digital wallets such as Apple Pay or Google Pay.

Tyl by NatWest currently accepts Mastercard, Visa and Discover® Global Network. Acceptance of American Express is expected soon.

Do you need to be a NatWest customer to use Tap to Pay on iPhone with NatWest Tap to Pay?

You do not need to bank with NatWest to use Tap to Pay on iPhone with NatWest Tap to Pay, but you do need to be signed up to Tyl by NatWest. Tyl by NatWest can be set up to pay into/out of any UK bank account, and the NatWest Tap to Pay app will automatically send transactions to your Tyl account and on to your nominated bank account.

Can I refund a Tyl transaction that hasn't been taken through NatWest Tap to Pay?

NatWest Tap to Pay only allows refunds on transactions that have been processed through NatWest Tap to Pay. The owner can process refunds on any NatWest Tap to Pay transactions across their business, but a staff member (with 'Cashier' access) can only perform refunds on transactions taken on their device/account.

See our longer list of FAQs to find out how to process a refund.