Taking Payments

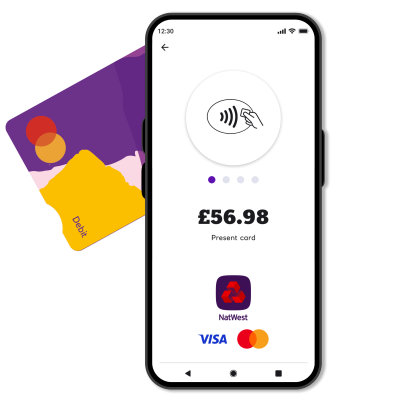

Using NatWest Tap to Pay you can accept contactless debit and credit cards including Visa, Mastercard as well as Apple Pay, Google Wallet and other digital wallets.

In this article:

- How do I take a payment with NatWest Tap to Pay?

- How should I position the customers card to take payment?

- What is the range of NFC?

- Why can’t my phone read a contactless card?

- What do I do if the payment requires the customer to enter a PIN code?

- Where are the payments I accept with NatWest Tap to Pay deposited?

- What should I do if I don’t receive my daily settlement?

How do I take a payment with NatWest Tap to Pay?

On the Tap to Pay app:

- Tap 'Sale'.

- Enter the amount and press 'confirm'.

- If you've enabled the Tip/Gratuity function you can now enter the tip either as an amount or choose a percentage. Once you're happy with the amount, tap ‘confirm’.

- The contactless tap icon and the amount will appear on screen. Show this to the customer, and have them tap and hold their payment card (or device) to the back of your phone (where the NFC sensor is).

- One the card is read successfully, the screen will display a 'Card read successful' message.

- The 'Payment successful' message will appear where you’ll have the option of sending or printing a receipt or showing a QR code to the customer to access their receipt.

Please refer to the Tap to Pay user guide for more details

How should I position the customers card to take payment?

Your NFC sensor (near field communication – the technology needed to take payments) is located on the back of your device, so place the customers card or device here when taking payment with the Tap to Pay app.

What is the range of NFC?

The maximum is around 10cm, but most devices work best at under 4cm - this helps with security. Also, don't just 'tap and go' - you need to hold the devices close for a few seconds.

Why can’t my phone read a contactless card?

Make sure your device has NFC and that it is switched on. This can be checked in your phone's settings. Go to Settings > Connections > NFC and contactless payments. Tap on the NFC switch to activate it.

What do I do if the payment requires the customer to enter a PIN code?

The need to enter a PIN code can be triggered if:

- the payment exceeds the contactless limit (currently £100 in the UK)

- the card issuer (such as their bank) requires additional security from the cardholder

NatWest Tap to Pay and Tyl support PIN entry in several ways:

- If your customer pays with a card that supports online PIN, a PIN entry screen will appear on your phone, where the customer can enter their code.

- If your customer is paying with a card that must be inserted into a reader, ask your customer if they have another card or a mobile wallet (Apple Pay, Google Wallet or Samsung Pay) to make the payment.

If you have another Tyl card reader, you can use this to complete the payment instead.

Where are the payments I accept with NatWest Tap to Pay deposited?

NatWest Tap to Pay is part of your Tyl suite of payment services, and works in the same way as our other ways to be paid (card readers, online, phone payments, and so on). So, your NatWest Tap to Pay sales all go to your Tyl account and are settled (paid) into your nominated bank account the next business day.

What should I do if I don’t receive my daily settlement?

You should get your daily settlement by the end of the next business day after the transactions took place. Occasionally there'll be delays, for example if a customer's raised a dispute or asked for a refund. If your settlement hasn't landed in your account give us a call on 0345 901 0001 and choose option 3, then option 2. We'll help you get it sorted.